Como entusiasta de los casinos en línea, me dediqué con gusto a explorar el sitio web de Pin Up Casino para compartir mi experiencia e impresiones con otros jugadores, especialmente con aquellos que están en Chile, como yo.

Lo primero que noté fue que el sitio web de Pin Up se destaca por su atractivo diseño. Los colores vivos y la interfaz intuitiva captaron mi atención de inmediato

Si estás fascinado con el encanto y la elegancia de una era pasada, no te pierdas nuestra sección dedicada exclusivamente al estilo pin up, donde podrás descubrir todos los secretos para recrear esta icónica moda en tu vida cotidiana. ¡Sumérgete en un mundo de glamour y feminidad!

Registro y Creación de Perfil

El proceso de registro fue bastante simple. Necesitaba ingresar mis datos personales básicos y confirmar mi cuenta. Fue agradable ver que el sitio toma en serio la seguridad y la privacidad de los datos.

- Acceso al Sitio del Casino

Primero, es necesario ir al sitio oficial del casino Pin Up.

- Pulsar el Botón de Registro

En la página principal del sitio generalmente se encuentra el botón “Registrarse”, que debes presionar para comenzar el proceso de creación de una cuenta.

- Ingreso de Datos Básicos

En el formulario de registro, generalmente se requiere ingresar información básica, como nombre, apellido, fecha de nacimiento, dirección de correo electrónico y número de teléfono.

También se suele requerir crear un nombre de usuario y contraseña para futuros accesos a la cuenta. - Elección de Moneda y País

Elegir la moneda preferida para jugar e indicar el país de residencia también son parte del proceso de registro.

- Aceptación de Términos y Condiciones

Normalmente, se requiere confirmar que has leído y estás de acuerdo con los términos de uso del casino y la política de privacidad.

- Confirmación de la Cuenta

Después de completar el formulario de registro, el casino puede solicitar la confirmación de la dirección de correo electrónico o el número de teléfono, enviando un código o un enlace para activar la cuenta.

- Verificación de Identidad

Algunos casinos en línea requieren verificación de identidad para completar el proceso de registro. Esto puede incluir la carga de documentos que confirmen tu identidad y dirección de residencia.

- Acceso a la Cuenta

Después de completar todos los pasos y confirmar la cuenta, podrás acceder a tu cuenta utilizando el nombre de usuario y contraseña elegidos.

- Establecimiento de Métodos de Pago

Por lo general, después del registro, se te ofrecerá agregar un método de pago para depositar fondos y comenzar a jugar con dinero real.

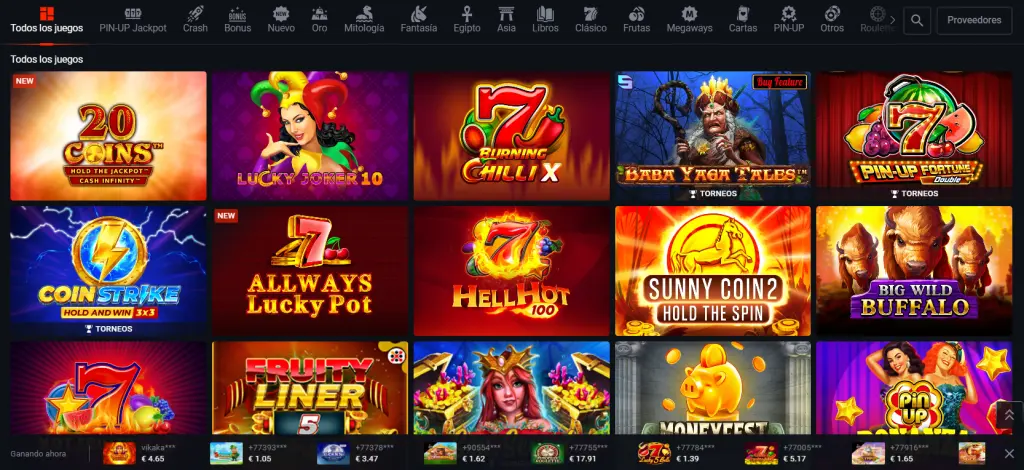

Variedad de Juegos

Luego procedí a explorar la variedad de juegos. Quedé impresionado por la diversidad de tragamonedas, desde las clásicas hasta las modernas con temas emocionantes. También había juegos de mesa y una sección con crupieres en vivo, lo que añadía autenticidad a la experiencia.

- Tragamonedas Clásicas

- En Pin Up Casino, encuentras las tragamonedas clásicas que nos recuerdan a los buenos tiempos de los casinos. Estos juegos generalmente tienen tres carretes y símbolos tradicionales como frutas, sietes y campanas. Son perfectos para aquellos que buscan una experiencia de juego simple y nostálgica.

- Tragamonedas de Video

- Las tragamonedas de video en Pin Up Casino son una verdadera atracción con gráficos avanzados y numerosas líneas de pago. Estos juegos ofrecen una variedad de temas, desde aventuras hasta mitología, y vienen con características especiales como giros gratis, rondas de bonificación y símbolos wild y scatter.

- Jackpots Progresivos

- Los jackpots progresivos son para aquellos que sueñan en grande. En Pin Up, cada apuesta aumenta el tamaño del premio mayor. Algunos de estos juegos tienen jackpots que pueden alcanzar millones, ofreciendo la posibilidad de ganar una fortuna con una sola tirada.

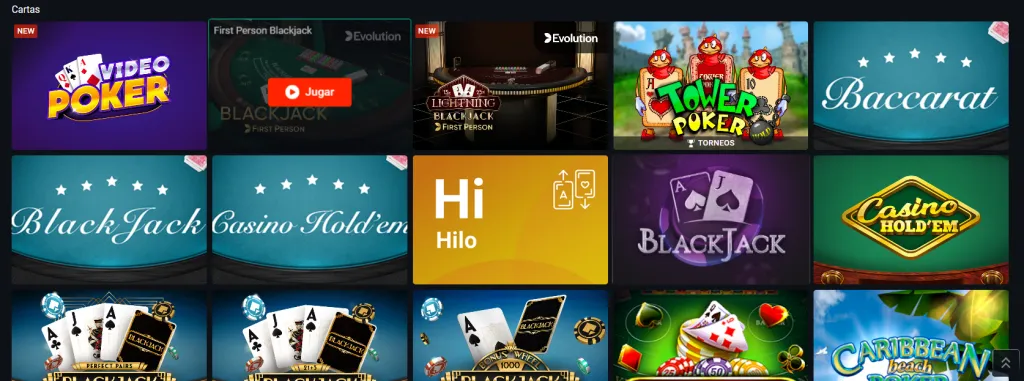

- Juegos de Mesa

- La selección de juegos de mesa en Pin Up es impresionante. Desde el clásico blackjack hasta diferentes versiones de ruleta y baccarat, hay algo para cada aficionado a los juegos de mesa. Estos juegos combinan estrategia y suerte, ofreciendo una experiencia de juego emocionante y variada.

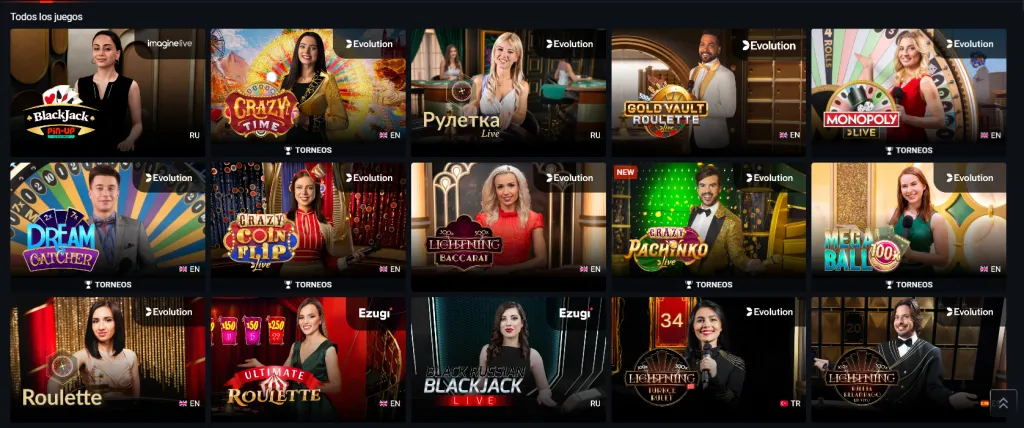

- Juegos con Crupieres en Vivo

- Los juegos con crupieres en vivo en Pin Up Casino te llevan a la acción del casino real. Puedes jugar blackjack, ruleta, póker y más, interactuando con crupieres reales y otros jugadores. Es la experiencia de casino más inmersiva disponible en línea.

- Juegos Especiales

- En la categoría de juegos especiales, Pin Up ofrece opciones como bingo, keno y tarjetas rasca y gana. Estos juegos son ideales para momentos de relax y ofrecen una forma divertida y sencilla de jugar sin necesidad de seguir reglas complicadas.

- Deportes Virtuales y Apuestas

- Para los amantes de los deportes, Pin Up tiene una sección de deportes virtuales. Puedes apostar en resultados de eventos deportivos simulados, que van desde fútbol hasta carreras de caballos, lo que añade un nivel emocionante de entretenimiento basado en la suerte.

Juegos Populares en Pin Up Casino (Chile)

| Nombre del Juego | Tipo de Juego | Apuesta Mínima (CLP) | Apuesta Máxima (CLP) |

|---|---|---|---|

| “Aztec Gold” | Tragamonedas de Video | 500 | 50,000 |

| “Ruleta Europea” | Ruleta | 1,000 | 100,000 |

| “Blackjack VIP” | Blackjack en Vivo | 2,000 | 200,000 |

| “Book of Dead” | Tragamonedas de Video | 300 | 30,000 |

| “Baccarat Pro” | Juego de Mesa | 1,500 | 150,000 |

Estos son algunos de los juegos más populares en Pin Up Casino en Chile, ofreciendo una amplia gama de opciones para todos los gustos y presupuestos. Desde emocionantes tragamonedas hasta juegos clásicos de mesa, hay algo para cada jugador.

Bonos y Promociones

Los bonos en Pin Up son realmente atractivos. Presté atención a las condiciones para recibir y apostar los bonos, y me gustó que todo estuviera claramente expuesto y fuera comprensible.

⚽️ Seguro del 100% para apuestas deportivas virtuales: Aprovecha esta oferta única – seguro del 100% en apuestas de fútbol virtual. Si pierdes tu apuesta, te devuelven el monto completo.

🏆 Apuesta gratis del 100% en VCT 2023: Game Changers Championship: Juega y apoya a tus equipos favoritos en el campeonato femenino de Valorant con una apuesta gratuita del 100%.

🏀 Victoria anticipada en partidos de la NBA: Haz una apuesta en la NBA, y si tu equipo lleva una ventaja de 18 puntos o más, puedes reclamar tu ganancia antes de que termine el juego.

🎰 Tres jackpots de PIN-UP: Prueba tu suerte en apuestas deportivas y obtén la oportunidad de ganar uno de los tres jackpots – oro, plata o bronce.

💰 Bono de bienvenida de 2 500 000 CLP: Recibe hasta 2 500 000 CLP como bono en tu primer depósito.

🔝 Top cuotas cada lunes: Benefíciate de apuestas en los principales eventos deportivos de la semana sin comisión.

🎲 Jackpots de hasta €100 000 en PIN-UP: Gana uno de los tres niveles de jackpot jugando en tragamonedas de Wazdan, Rubyplay y otros.

✅ Bono del 100% en apuestas combinadas: Aumenta tus ganancias con un bono del 100% en apuestas que contienen dos o más eventos.

🎫 Dobles ganancias los lunes: Obtén ganancias dobles cada lunes haciendo apuestas en PIN-UP.

⚽️ Condiciones especiales para fútbol y hockey: Gana apuestas anticipadamente con una ventaja de dos goles en fútbol y tres en hockey.

💸 CashOut y edición de apuestas: Asegura tus ganancias y edita tus apuestas incluso después de haberlas realizado.

📈 Multiplicador 1.15 en apuestas múltiples diarias: Aumenta tus posibilidades de ganar usando el multiplicador adicional 1.15.

📺 Jackpots en TVBET: Gana en tres tipos diferentes de jackpots jugando emocionantes juegos de TV.

🎉 Cashback semanal y caja de regalo: Recibe cashback semanal y cajas de regalo por jugar activamente.

🏆 Pago anticipado en apuesta ‘Más de X’: Obtén un reembolso inmediato de tu apuesta si los jugadores marcan X goles.

🎁 2 500 000 CLP + 250 giros gratis: Comienza tu juego con grandiosos bonos y giros gratis.

🎯 Trivia de Black Friday: Participa en la trivia y gana hasta 80 giros gratis.

Bonos en Pin Up Casino (Chile)

| Nombre del Bono | Descripción | Monto Máximo (CLP) |

|---|---|---|

| Bono de Bienvenida | Bono por el primer depósito | 2 500 000 |

| Bono de Cumpleaños | Bono personal en tu cumpleaños | Variable |

| Cashback | Devolución semanal de una parte de los fondos perdidos | Variable |

| Bono por Referir Amigos | Bono por cada amigo referido que se registre y comience a jugar | Variable |

| Torneos y Promociones Especiales | Torneos regulares y promociones con premios en efectivo y bonos | Variable |

Estos bonos en Pin Up Casino son una gran oportunidad para los jugadores en Chile. Desde generosos bonos de bienvenida hasta emocionantes torneos, hay muchas formas de aumentar tus ganancias y disfrutar jugando.

Métodos de Depósito y Retiro de Fondos

Como jugador en Chile, era importante para mí asegurarme de que estuvieran disponibles métodos de pago locales convenientes. Pin Up ofrece una amplia gama de opciones, lo que facilita enormemente el proceso de transacciones.

- Tarjetas Bancarias

- Visa

- MasterCard

- Monederos Electrónicos

- Skrill

- Neteller

- Criptomonedas

- Bitcoin

- Ethereum

Estos métodos de pago reflejan la versatilidad y adaptabilidad de Pin Up Casino para satisfacer las necesidades de sus jugadores chilenos, ofreciendo opciones tanto tradicionales como modernas.

Métodos de Depósito en Pin Up Casino (Chile)

| Método de Depósito | Monto Mínimo (CLP) | Monto Máximo (CLP) | Tiempo de Procesamiento |

|---|---|---|---|

| Visa | 5,000 | 500,000 | Inmediato |

| MasterCard | 5,000 | 500,000 | Inmediato |

| Skrill | 10,000 | 1,000,000 | Inmediato |

| Neteller | 10,000 | 1,000,000 | Inmediato |

| Bitcoin | 20,000 | Sin límite | Hasta 24 horas |

| Ethereum | 20,000 | Sin límite | Hasta 24 horas |

Como jugador apasionado por los casinos, aprecio la flexibilidad que Pin Up Casino ofrece en Chile con sus métodos de depósito, adaptándose tanto a pequeñas como a grandes sumas, y proporcionando procesamiento rápido, lo cual es esencial para una experiencia de juego fluida.

Versión Móvil y Aplicaciones

Usando mi smartphone, también revisé la versión móvil del sitio. Resultó ser conveniente, funcional y tan completa como la versión de escritorio del sitio.

Soporte al Jugador

El servicio de atención al cliente en el sitio está disponible a través de varios canales. Aunque no necesité pedir ayuda, era evidente que el soporte al cliente es una prioridad para Pin Up.

Seguridad y Fiabilidad

También presté atención a las cuestiones de seguridad. El sitio utiliza métodos modernos de encriptación de datos y cuenta con las licencias apropiadas, lo que habla de su fiabilidad.

Preguntas Frecuentes

Para registrarte, necesitas ir al sitio oficial de Pin Up Casino, hacer clic en el botón “Registrarse” y seguir las instrucciones. Necesitarás ingresar tus datos personales, correo electrónico y crear una contraseña.

Pin Up Casino ofrece varios bonos, incluyendo un bono de bienvenida, bonos por depósito, giros gratis y otras promociones. Puedes encontrar información detallada sobre los bonos actuales en el sitio del casino en la sección “Promociones”.

Los métodos de depósito incluyen tarjetas bancarias, monederos electrónicos, transferencias bancarias, tarjetas prepagadas y, posiblemente, criptomonedas. Los métodos disponibles pueden variar según tu región.

Para retirar fondos, inicia sesión en tu cuenta, ve a la sección “Caja” y elige “Retirar fondos”. Luego selecciona tu método de retiro preferido, especifica la cantidad y sigue las instrucciones.

Sí, Pin Up Casino ofrece una aplicación móvil para dispositivos Android e iOS. Puedes descargarla desde el sitio oficial del casino.

Pin Up Casino utiliza tecnologías modernas de cifrado para proteger los datos de los jugadores y cumple con todos los estándares de seguridad necesarios. El casino también tiene las licencias correspondientes.

Sí, muchos juegos en Pin Up Casino están disponibles en modo demostración, lo que te permite jugar gratis sin apostar dinero real.

En general, mi experiencia con Pin Up Casino ha sido muy positiva. Este casino ofrece una amplia gama de juegos, generosos bonos y métodos de depósito y retiro convenientes. Definitivamente lo recomendaría tanto a jugadores experimentados como a aquellos que son nuevos en el mundo de los casinos en línea, especialmente a aquellos que están en Chile.